10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

- Avalanche’s native token AVAX underperformed the crypto market over the past week ahead of its token unlocking event, CoinDesk data shows.

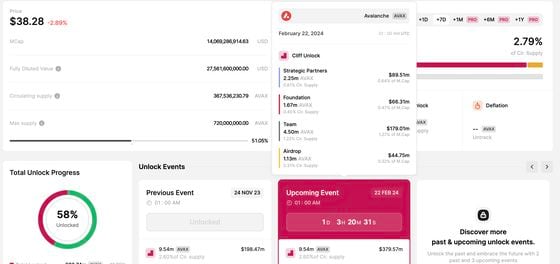

- Some $365 million worth of locked-up tokens will be released Thursday from vesting and will be added to circulation, according to Token.Unlocks data.

The native cryptocurrency of the Avalanche (AVAX) network underperformed most digital assets as the token undergoes a $365 million unlocking event this week that will increase the token’s supply.

AVAX dipped more than 3% over the past week, while most cryptocurrencies – 148 of the 173 constituents of the broad-market CoinDesk Market Index (CMI) – gained in price. The CoinDesk20 Index (CD20), which tracks the performance of the largest and most liquid crypto assets, advanced 6% during the same period. At press time, AVAX changed hands at $38, some 23% lower than its December high.

The underperformance happened as some 9.5 million of previously locked-up AVAX tokens, worth $365 million, will be released on Thursday, increasing the asset’s circulating supply by roughly 2.6%, according to data from Token.Unlocks.

Some 4.5 million tokens will be transferred to team members, 2.25 million to strategic partners, 1.67 million to the ecosystem development foundation, while 1.13 million are earmarked for airdrop.

Approximately 58% of all of AVAX’s tokens have been unlocked, on-chain data shows.

Token unlocks translate to an increase in the asset’s supply, releasing previously locked-up coins from a vesting period, including to early investors.

Large unlocking events usually lead to price declines within two weeks due to the supply increase outpacing investor demand for the asset, a report by crypto analytics firm The Tie found last year.

Edited by Sam Reynolds.