Bitcoin has been named the best performer among asset classes in 2023, but the cryptocurrency is still struggling to break new levels in its price. Despite the current bearish sentiment, many analysts have hinted and predicted a bull run in the coming months, especially as the market awaits the approval of a spot Bitcoin ETF.

This has probably prompted many investors to hold on to their coins, as on-chain metrics have shown that the amount of Bitcoin supply idling recently reached a new all-time high.

Unmoved Bitcoin Supply Reaches Record High

The industry expects the SEC’s approval of spot Bitcoin ETFs to ignite the next bullish run for the price of Bitcoin. Although the SEC has so far rejected a number of requests for Bitcoin ETFs, many analysts believe it will not be long until one is accepted.

Considering Bitcoin’s dominance of the entire crypto market capitalization, a spike in Bitcoin’s price is expected to flow into all other cryptocurrencies. As a result, investors have been keeping their holdings in expectation of a future price increase.

Recent data has shown that 94.8% of the total Bitcoin supply has not moved in the past month, indicating a new all-time high for the metric.

Similarly, a recent post by on-chain intelligence platform Glassnode alerts revealed that the amount of HODLed or lost Bitcoin reached a 5-year high of 7,906,288.227 BTC.

The overall Bitcoin net flow into exchanges has decreased by 862.42 BTC ($23.27 million) in the past 24 hours, according to chart insights provided by IntoTheBlock. While this is relatively small compared to Bitcoin’s market cap, it shows investor mood might be changing into a bullish sentiment.

Time For Reversal?

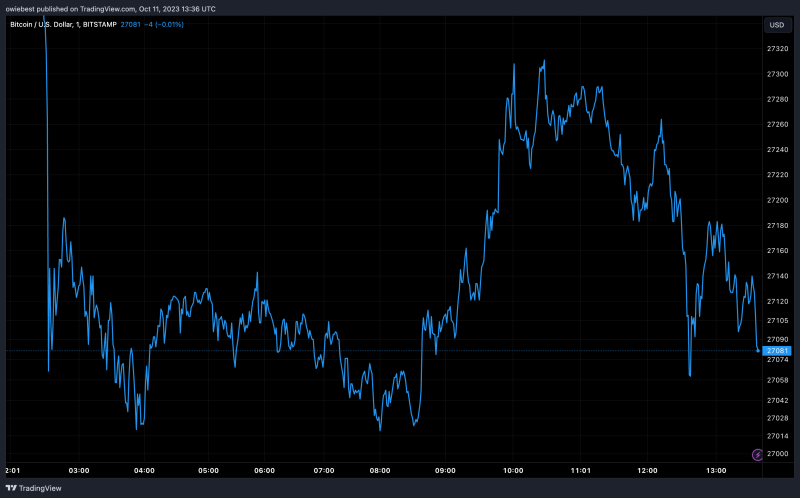

Bitcoin’s price just rebounded up to $27,100 after failing to gain traction above the $27,800 resistance in the midst of escalating Israel-Hamas tensions in the Middle East. Despite this, BTC still remains the best-performing investment asset this year, outperforming stocks and bonds with its year-to-date (YTD) return of 63.3%.

Recent happenings, particularly the tension of an oncoming recession in the US, have prompted billionaire hedge fund manager Paul Tudor Jones to assert that this is the best time to buy Bitcoin.

Featured image from Shutterstock, chart from Tradingview.com