- Bitcoin dominance reaches a new cycle high of 58.91%, a level last seen in April 2021.

- A major factor in rising bitcoin dominance is ether’s relative underperformance.

Unmute

00:52Ether ETFs Saw Biggest Outflows Since July

01:01Bitcoin Breaks $64K While Gold Soars

00:56ETH/BTC Ratio Slid to Lowest Since April 2021

00:57Is Bitcoin Losing Its Bullish Momentum?

The cryptocurrency market as a whole continued moving higher on Wednesday, led by bitcoin (BTC), which extended its week-over-week gain to more than 12%, rising above $68,000 for the first time since late July. The broad market gauge CoinDesk 20 Index was higher by just 9% over the same time frame.

Bitcoin’s “dominance,” i.e. its share of the total cryptocurrency market capitalization, has now jumped to 58.91% from 57.13% at the start of October. That’s a new cycle high and the strongest reading since April 2021, according to TradingView’s TOTAL, which shows a total crypto market cap of $2.281 trillion and $940 billion when excluding bitcoin.

Bitcoin dominance rose to above 70% at one point during the 2020-21 bull market before declining to as low as 40% in mid-2021. Dominance hovered around those levels for more than a year, finally bottoming alongside the collapse of crypto exchange FTX in late 2022. A steady rise than began, which has continued up to the current time.

Ether to bitcoin ratio

Behind much of bitcoin’s rising dominance is the relative decline in the second-largest crypto by market cap, ether (ETH). The current ether/bitcoin ratio of around 0.03850 is at its weakest level since April 2021.

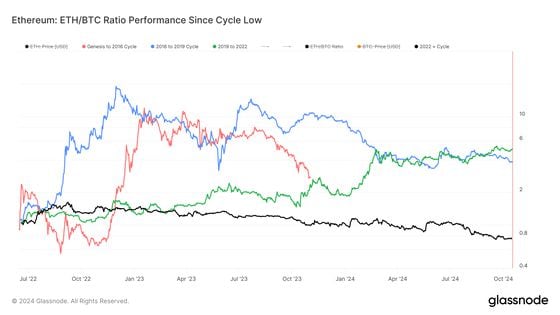

A closer look at the ETH/BTC ratio from its cycle bottom in June 2022 shows a continuing series of weaker lows. In previous cycles, such as the 2016-2019 and 2019-2022 periods, the ETH/BTC ratio was at least 200% higher from the cycle low at this point. However, the current ratio is 25% beneath its June 2022 cycle low, highlighting ether’s underperformance against bitcoin.

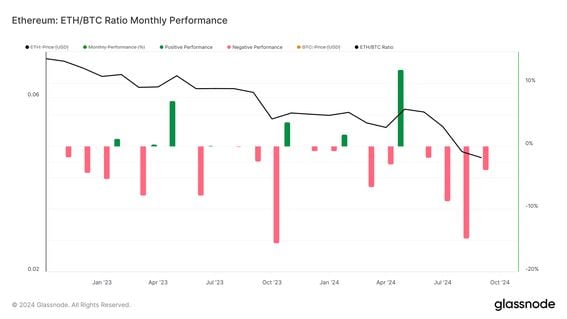

Lastly, ether has outperformed bitcoin in just seven of the past 23 months. Ether’s most recent month of relative outperformance was back in May 2024.

Edited by Stephen Alpher.