BlackRock accumulated Bitcoin worth millions as the king coin’s price went below $43k.

Edited By: Saman Waris

- BTC’s price moved marginally over the last 24 hours.

- Selling pressure on BTC was high, and indicators looked bearish.

Bitcoin’s [BTC] price witnessed a downfall days after the much-awaited ETF approval. However, institutional investors grabbed this opportunity to accumulate more BTC. Will this stockpiling have a positive impact on the king coin’s price?

Bitcoin to recover soon?

The ETF approval scene was a disaster for the king of cryptos, as its price went under the $43,000 mark. According to CoinMarketCap, BTC was trading at $42,894.93 at press time, with a market capitalization of over $840 billion.

Regardless, institutional investors did not stop buying BTC. On the 15th of January, American multinational investment company BlackRock bought 11.5k BTC.

AMBCrypto’s converter revealed that the stockpiled BTCs were worth more than $490 million at press time.

BlackRock buys 11,500 Bitcoin during the dip.

Bought enough Bitcoin to cover what would be mined in 13 days. pic.twitter.com/6cI6npxg7s

— Kashif Raza (@simplykashif) January 15, 2024

AMBCrypto also took a look at other datasets to better infer whether the king coin was facing high buying pressure at press time. Our analysis revealed a bearish picture, suggesting a sell-off.

Most importantly, BTC’s Supply on Exchanges rose while its Supply outside of Exchanges dropped, meaning the selling pressure was high.

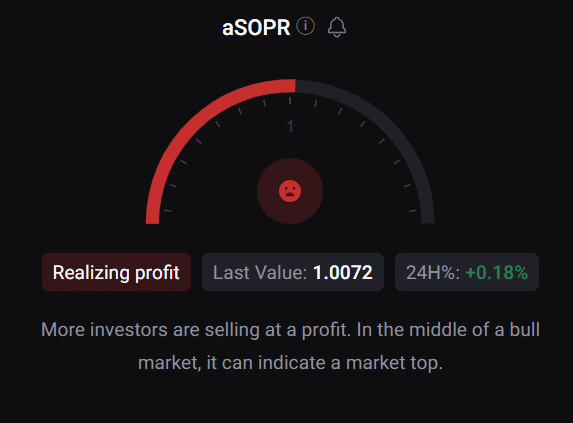

Not only that, but CryptoQuant’s data pointed out that BTC’s exchange reserve was increasing. Moreover, its aSORP was red, meaning that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Is a trend reversal possible?

Though the above metrics looked bearish, on the 15th of January, the price of the king coin had reached a crucial resistance level. This level had previously triggered a bull rally back in 2020.

Therefore, to better understand the viability of a BTC bull rally in the near term, AMBCrypto checked its daily chart. We found that Bitcoin’s Relative Strength Index (RSI) gained upward momentum and was headed toward the neutral mark at press time.

However, other indicators were not positive. Bitcoin’s MACD displayed a clear bearish advantage. Its Chaikin Money Flow (CMF) also went down, showing increased chances of a price decline.