“The recent selloff in crypto markets is likely near an end, with long-position liquidations “largely behind us,” the report states.

Bitcoin Futures Interest, The Key Indicator

A recent report that cites JPMorgan research, highlights buyer demand for Bitcoin futures contracts as an indicator hinting at market optimism for a potential surge in demand for Bitcoin.

Bitcoin Futures, which involve contracts to buy or sell crypto Bitcoin at a set price on a specific future date, are traded on the Chicago Mercantile Exchange (CME).

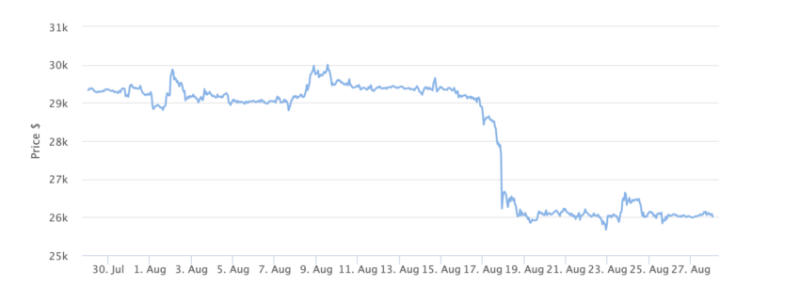

Bitcoin Price Chart 1 Month. Source: BeInCrypto

The report states that there is a decline in the “number of unsettled and active future contracts trading on exchanges.” This suggests a growing interest in acquiring Bitcoin. It also hints that the downward price trend might be coming to an end.

Nikolaos Panigirtzoglou believes this indicates there could be a reversal in the market shortly:

“As a result, we see limited downside for crypto markets over the near term.”

To learn more about where to buy Bitcoin, read BeInCrypto’s guide: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2023

When the reversal trend might start was uncertain. However, the report noted the slowing down of price decline, pointing to Bitcoin being down “0.2% at around $25,980 as of 11:30 a.m. in New York on Friday.”

This is a developing story and more information will be added as it becomes available.