DOGE consolidates recent gains above a liquidity area of $0.065. Is another rebound likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

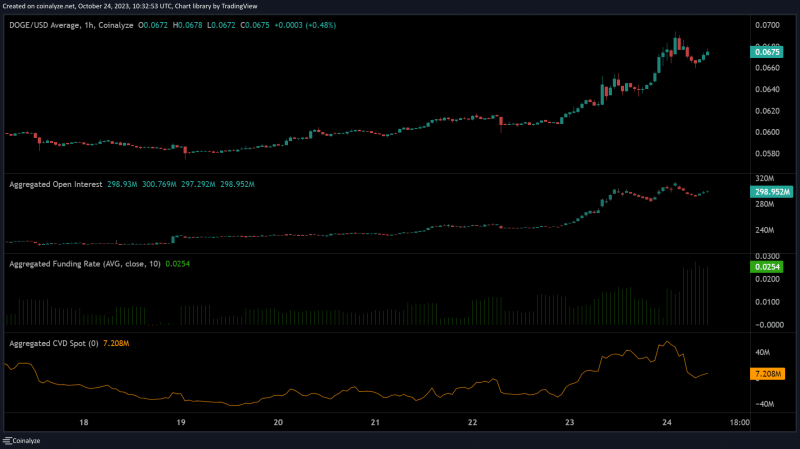

- Liquidity on DOGE’s charts existed at $0.065.

- The funding rates remained positive.

Dogecoin’s [DOGE] price performance remained below single-digit gains during the ongoing recovery. It posted 4% gains in the week of 16 – 22 October. The recovery was extended in the past two days (23-24 October) and climbed above a resistance level of $0.0647.

Meanwhile, Bitcoin [BTC] hit $35k as bullish bets swung amidst hints of BlackRock’s readying for BTC ETF approval. However, BTC’s sharp upswing didn’t push DOGE beyond $0.070. Can DOGE bulls drive another leg of recovery?

Bulls eyed $0.065 area

On the charts, liquidity was at $0.065, the area marked in white. Interestingly, the level sat above the previous resistance of $0.0647.

At press time, price action was above the $0.065 liquidity area but hadn’t moved beyond $0.070. The alignment of liquidity and previous resistance could make the level ideal for near-term bulls to seek re-entry.

A rebound at the liquidity will offer 11% gains if the jump extends to the overhead hurdle and breaker block at $0.075(red). Alternatively, sellers’ leverage will be confirmed if price action retreats below $0.063 and the liquidity area.

The immediate support to consider for such a downswing will be $0.060. Meanwhile, the RSI and CMF were positive and denoted substantial buying pressure and capital inflows.

Funding rates remain positive

Despite consolidating recent gains below $0.070 at press time, overall sentiment remained positive for the DOGE. Positive funding rates confirmed the above stance.

The Open Interest rates also improved in the past few days and underscored a spike in demand for the meme coin in the derivatives market.

But buyers didn’t have an absolute market edge, especially on the lower timeframe as of press time. The inference above was drawn from the downward sloping CVD (Cumulative Volume Delta), which showed sellers’ spirited fight.