Upcoming SEC meetings with Spot Ethereum ETF applicants could signal a shift in regulatory engagement, potentially impacting the Ethereum price trend. By Coingape Staff 16 hours ago Updated 10 hours ago

Highlights

- Spot Ethereum ETF applicants are set to have a discussion with the SEC staff.

- Though the development doesn’t signal an approval of Ether ETFs, it implies that the SEC will break its ‘radio silence’ on the matter.

- The ETF applicants could also potentially influence the SEC’s decision with their arguments.

As speculations swirl around the approval of Spot Ethereum ETFs, Fox journalist Eleanor Terrett revealed that upcoming meetings are scheduled between ETF applicants and staff members of the U.S. Securities and Exchange Commission (SEC). This disclosure follows a series of mixed sentiments from industry insiders regarding the likelihood of approval.

Ethereum ETF Applicants To Meet SEC Staff

The discourse began with Nate Geraci, co-founder of The ETF Institute, sharing insights from a conversation with a prospective Spot Ethereum ETF issuer. The issuer expressed “extreme pessimism” about the approval prospects. Earlier, Matthew Sigel, head of digital asset research at VanEck, one of the applicants for a Spot Ethereum ETF, echoed a similar sentiment.

Moreover, Sigel’s remarks during a podcast indicated a lack of optimism from VanEck’s perspective, adding to the prevailing uncertainty. However, the revelation by Terrett suggests a potential shift from the previous “radio silence” from the SEC. While these scheduled meetings do not guarantee approval, they signify a departure from the perceived lack of engagement by the regulatory body.

This newfound communication could offer Ethereum ETF applicants an opportunity to address any concerns or provide additional information to the SEC. Moreover, it could even potentially influence the decision-making process. The significance of these scheduled meetings lies in the potential for increased transparency and dialogue between ETF applicants and regulatory authorities.

Such engagement can help clarify regulatory expectations and requirements, facilitating a more informed evaluation of the Ethereum ETF proposals. Additionally, it reflects a proactive approach by both parties to navigate the complexities of introducing Ethereum-based financial products into the market.

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

ETH Price Trend

Moreover, the outcome of these meetings could have broader implications for the crypto and financial markets. Approval of Spot Ethereum ETFs could open the door for broader institutional participation in Ethereum, potentially driving increased liquidity and market stability. Hence a Ethereum price rebound or even a parabolic surge can be expected.

Conversely, a denial or prolonged delay could dampen investor sentiment and even negatively affect the ETH price. Michaël van de Poppe, a renowned crypto analyst on X, noted that a potential denial of Spot Ethereum ETFs could push the ETH price down to a low of $2,700, while it currently trades at $2,900.

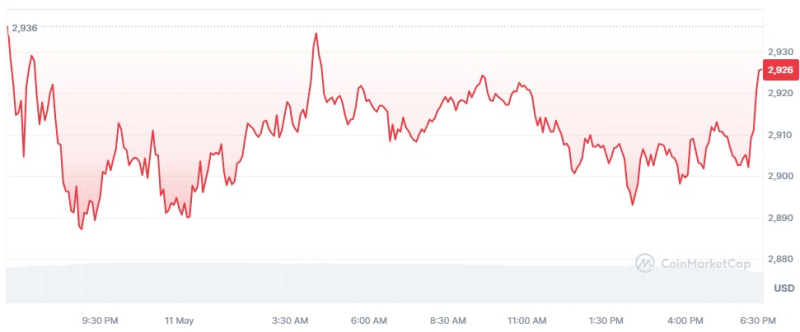

However, at press time, the Ethereum (ETH) price recovered from the major crypto selloff but was still down by 0.13%, exchanging hands at $2,919. Concurrently, ETH’s market capitalization and 24-hour trading volume fell by 0.46% and 13.04%, respectively, to $351,480,309,908 and $9,569,355,891.

ETH/USD 24-hour price chart (source: CoinMarketCap)

Meanwhile, Ark Invest and 21Shares have dropped the staking feature from their combined Ether ETF application. Earlier, Grayscale withdrew its Ethereum futures ETF. Netizens speculate that Ark 21Shares’ could prove to be beneficial for the applications as the SEC had earlier cast down on the staking feature.

Moreover, Grayscale’s withdrawal of ETH futures ETF is also seen as a positive development. The community believes that the asset manager wouldn’t drop the application if it wasn’t sure of an imminent approval of the Spot Ethereum ETF. The narrative stems from Grayscale’s relentless battle in the Spot Bitcoin ETF arena, which led to the approval of these investment products.