Contents

Explore what Ethereum price today is doing and what needs to happen for ETH to trigger a rally to $5,000 instead of crashing to $3,000. By Akash Girimath 1 minute ago

Highlights

- Ethereum price today is up 0.95% and is likely to continue its ascent.

- If Bitcoin hits $100,000 ETH could follow its suit and clear key resistance level of $3,500.

- A successful breakout could send Ether to $5,000.

Ethereum (ETH) price trades today at $3,417.0 as of 1 PM. Ether prices hit a daily high of $3,419.3 today after rising 3.81% on November 23.

Why is Ethereum Price Rising Today?

After crashing 11% in the past three days, Ethereum price today is up 3.81% and trades at $3,042. As of November 16, there are promising signs that the value of ETH could continue heading higher and tag key resistance levels.

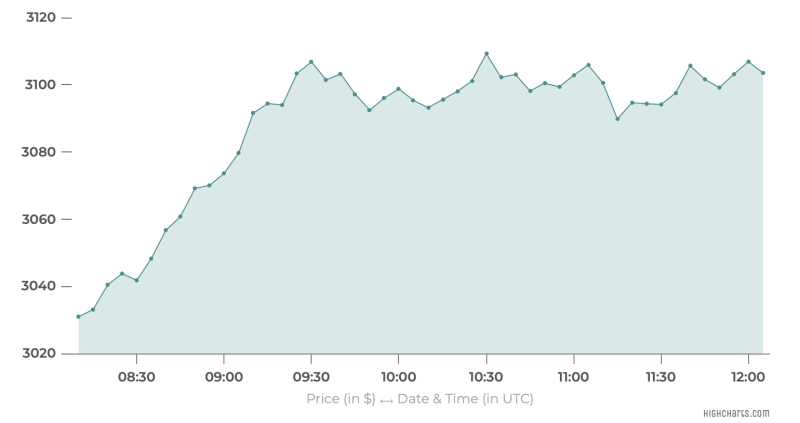

Ethereum Price Today

Ethereum Price Chart Today

*Ethereum price updated as of 1 PM.

Ethereum’s innovative smart contract technology has made it a standout altcoin since its inception in 2015. Continuous major network upgrades ensure Ethereum stays ahead in smart contract innovation. The latest upgrade, Cancun, launched on March 13, 2024.

Ethereum Price & Historical Data

ETH’s year-to-date (YTD) performance continues to increase and currently sits at 33%. This recent slump in Bitcoin price has affected the YTD gains, which have dropped from 50% since November 11. As of November 23, 2024, if you invested $10,000 in ETH on January 1, 2024, your portfolio, after 317 days, would be up roughly $3,317. Ethereum’s market capitalization stands at $411.7 billion.

Ethereum: The Second-Largest Crypto By Market Cap

Ethereum ranks second in market capitalization, valued at $411.7 billion, after Bitcoin’s $1.73 trillion. Together, BTC & ETH’s market capitalization constitutes 83% of the total crypto market cap.

Since its all-time high of $571 billion in November 2021, Ethereum’s value decreased by half in October, but has spiked recently due to Bitcoin’s new ATH. Still, Ethereum maintains a strong lead over other popular cryptocurrencies:

- Solana (SOL): $98.8 billion

- Ripple (XRP): $89.8 billion

- BNB (BNB): $91.0 billion

Despite this recent downtick and recovery, the 24-hour trading volume of Ethereum is $38.0 billion.

Ethereum’s Crypto Trading Volume Remains High

The 24-hour trading volume of Ethereum is $38.0 billion. Binance is the largest contributor to this trading volume – about 11% is contributed by spot trading and nearly 40% from futures trading. Exchanges like OKX, Bitget, and ByBit follow Binance.

Ethereum Shifts From PoW to PoS

The London hard fork is a significant Ethereum blockchain upgrade. It changed the network from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Ethereum co-founder Vitalik Buterin recently shared his thoughts on X (formerly Twitter). He explained how Proof-of-Stake (PoS) is more decentralized than Proof-of-Work (PoW).

Key Ethereum Upgrades in The Past Five Years

Here are some key upgrades in the past five years that shaped Ethereum as the second-largest crypto by market capitalization.

2024:

- Cancun-Deneb (“Dencun”): This upgrade aimed to improve Ethereum’s scalability, security, and usability, setting the stage for further enhancements.

2023:

- Shanghai-Capella (“Shapella”): Enabled the withdrawal of staked Ether (ETH), marking a significant milestone in Ethereum’s transition to a Proof-of-Stake (PoS) consensus algorithm.

2022:

- Paris (The Merge): Successfully transitioned Ethereum from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus algorithm, reducing energy consumption and increasing security.

- Bellatrix: Prepared the Ethereum network for The Merge by introducing the necessary PoS consensus logic.

- Gray Glacier: Delayed the “difficulty bomb” that would have slowed down the network, ensuring a smooth transition to PoS.

2021:

- Arrow Glacier: Delayed the “difficulty bomb” again, providing more time for the transition to PoS.

- Altair: Introduced several improvements to the Beacon Chain, including better validator incentives and enhanced security.

- London: Implemented the highly anticipated EIP-1559, which reformed the transaction fee market, making it more efficient and user-friendly.

- Berlin: Introduced several protocol upgrades, including improved gas efficiency and enhanced security features.

2020:

- Beacon Chain genesis: Launched the Beacon Chain, marking the beginning of Ethereum’s transition to PoS.

- Staking deposit contract deployed: Enabled users to deposit ETH and participate in the PoS consensus algorithm.

-

Muir Glacier: Delayed the “difficulty bomb” to ensure a smooth transition to PoS.

ETH Gas & Its Effect on Ethereum Price

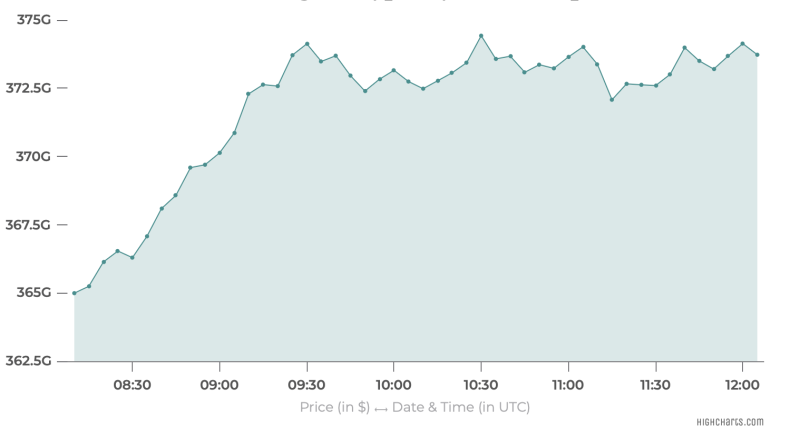

The blockchain upgrades Ethereum receives aim to solve the trilemma of blockchain, i.e., balancing decentralization, security, and scalability. The switch to Proof-of-Stake (PoS) enhanced these aspects. Ethereum’s transaction fees (gas fees) plummeted post-upgrade, drawing more investors. Gas fees are like taxes, measured in Gwei, required for secure transactions.

As of November 23, the gas fee for a transaction on the ETH network as of 1 PM is 15.84 Gwei.

When Ethereum’s on-chain value grows, presenting opportunities, investors flock, driving gas fees up. This typically occurs during market upswings, peaking at all-time highs.