10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

Price volatility following a from the U.S. Securities and Exchange Commission (SEC)’s X account caused nearly $90 million worth of bitcoin (BTC) long and short positions to be liquidated, showcasing manipulation risks associated with the industry.

Hackers caught hold of SEC’s X account on Tuesday, using it to post a nod for the much-awaited bitcoin exchange-traded fund (ETF) approval decision. It later posted “$BTC,” before both tweets were promptly deleted.

Those tweets caused bitcoin prices to immediately spike to $47,680 from the $46,800 level. It then fell as low as $45,400 as the tweets were found to be fake.

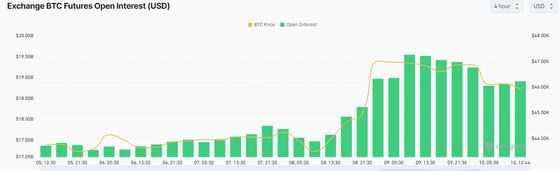

Punters and automated bots, however, reacted quickly to the tweets. Over $500 million in futures positions were opened in a ten-minute period following the initial post, data shows. But the highly-levered positions took a hit as prices whipsawed: Some $50 million in longs were liquidated while $36 million in shorts were impacted.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Such data is beneficial for traders as it serves as a signal of leverage being effectively washed out from popular futures products – acting as a short-term indication of a decline in price volatility.

A decision on thirteen proposed bitcoin ETFs is expected on Wednesday, with Bloomberg analysts placing approval odds at over 90% and crypto market bettors a relatively smaller 85%.

Meanwhile, some crypto market participants criticized the SEC’s seemingly lax security measures to protect its account – even asking how the financial regulator could safeguard trillion-dollar markets if it .

Edited by Parikshit Mishra.