Hong Kong Bitcoin and Ethereum ETFs note remarkable weekly inflows, surpassing the United States Spot BTC ETF, one of the largest markets with 63,487 AUM. By Coingape Staff 7 hours ago

Highlights

- Hong Kong records weekly inflows worth $300 million in Bitcoin and Ethereum ETFs.

- The U.S. spot Bitcoin ETFs continue to record outflows, with $860 million registered this week.

- GBTC tops the outflow list on May 2, with other ETF service providers noting undermined inflows.

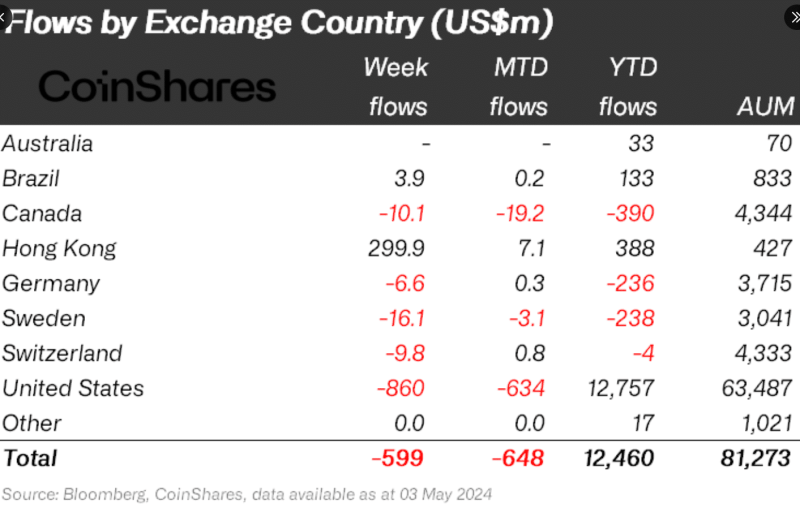

In an unprecedented turn of events, while the global digital asset ETF market bled over the past week, Hong Kong stole the spotlight, noting remarkable inflows. Outpacing the U.S. Spot Bitcoin ETF market, the largest market with 63,487 AUM (Assets under management) in weekly flows, the Asian crypto ETF market appears to be gradually carving its own path.

Following a sluggish start witnessed with the launch of Bitcoin & Ethereum ETFs in Hong Kong, nearly $300 million worth of weekly inflows recorded marked a monumental achievement across the globe. The U.S. spot Bitcoin ETFs, on the other hand, recorded outflows worth a staggering $860 million over the past week, stirring speculations.

Hong Kong Leads The Way

According to data from CoinShares, the digital asset ETF market saw significant outflows this week, with Hong Kong and Brazil being the exceptions. Hong Kong led the way with remarkable $299.9 million weekly inflows, only to be followed by Brazil with $3.9 million weekly inflows.

Notably, Hong Kong hosts three major crypto-related ETF service providers: Harvest Global Investments Ltd., the local unit of China Asset Management, and a partnership between HashKey Capital Ltd. and Bosera Asset Management (International) Co.

Whereas, it’s worth noting that the U.S., Switzerland, Sweden, Germany, and Canada registered substantial outflows, further igniting inferences.

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

The U.S. spot Bitcoin ETFs’ outflows appear to be primarily stemming from the recent FOMC meeting, wherein Jerome Powell kept interest rates unchanged again. This, collectively, paved the path for Hong Kong to lead the way, registering the maximum amount of inflows surrounding crypto-related ETFs across the globe.

Latest Data On U.S. Spot Bitcoin ETFs

Further, per insights offered by Farside Investors UK, the net outflows from U.S. spot Bitcoin ETFs on Thursday, May 2, totaled $34.4 million, a minor blip compared to the whopping $563.7 million recorded on May 1, the day Powell announced unchanged rates. Besides, On May 2, BlackRock’s IBIT Bitcoin ETF, Fidelity’s FBTC, and Bitwise’s BITB recorded zero flows.

Ark Invest’s ARKB recorded $13.3 million inflows, followed by Valkyrie’s BRRR, Franklin Templeton’s EZBC, and Invesco Galaxy’s BTCO, which recorded $2.3 million, $3.4 million, and $1.5 million inflows, respectively. However, Grayscale’s GBTC noted $54.9 million in outflows, staging as the lion’s share in May 2’s outflows recorded.