The price of Pepe has plummeted 15% after developers sent nearly 4% of the memecoin’s total supply to exchanges without warning.

The price of the frog-themed memecoin Pepe (PEPE) has plunged nearly 15% after recent changes to a multisig wallet and new token transfers ignited fears of a “rug pull” by its developers.

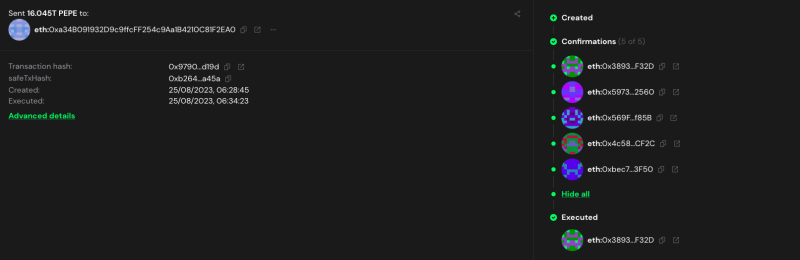

The allegations — as well as the negative price action — came as $16 million worth of Pepe tokens were sent from the developers’ multisig wallet to various crypto exchanges on Aug. 24.

1/4

1 hour ago, the Pepe multisig wallet, changed the amount of signatures required on their multisig from a 5/8 to 2/8. This comes after sending $15.7 million worth of $PEPE to exchanges.

A breakdown of what we know: pic.twitter.com/bxBxp6Nzqz

— ASXN (@asxn_r) August 24, 2023

According to data from blockchain custody app Safe Global, the wallet address transferred 16 trillion Pepe tokens — approximately 3.8% of the total supply — to three exchanges and an unverified wallet address.

Data shows $8.2 million worth of Pepe was sent to OKX, $6.5 million to Binance and $434,000 to Bybit, while an additional $400,000 was transferred to an unknown wallet.

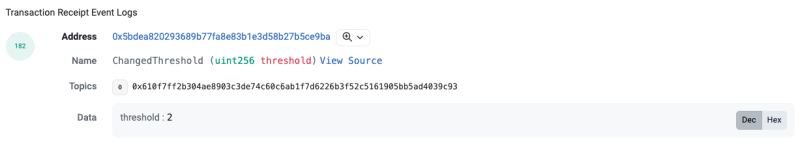

Following the transfer of the 16 trillion Pepe tokens to exchanges, the developers made a curious change to the team’s multisig wallet, which at the time of publication still contains $10 million worth of Pepe.

Data from Etherscan shows that the wallet now only requires two out of eight signatures — formerly five out eight — to sign off on whether or not the wallet should make transfers.

Notably, the transfer of funds marked the first time that Pepe tokens had ever been sent from the project’s multisig wallet to exchanges.

Many memecoin investors heralded Pepe as the next major memecoin, with some suggesting that — come the next bull run — the frog-themed meme token was capable of “flipping” the original memecoin, Dogecoin (DOGE).

The movements of funds out of the multisig could throw this thesis, for some, into question.