The heightened regulatory scrutiny initiated intense discourse about classifying specific cryptocurrencies as securities while negatively impacting the prices of many altcoins mentioned in the lawsuits.

Unfurling the SEC’s Stance

At the epicenter of this legal maelstrom, Binance, led by its iconic founder Changpeng Zhao, faces allegations of intermingling billions of users’ funds. The world’s largest crypto exchange by trading volume allegedly breached regulations to accommodate wealthy US traders on its global platform.

SEC Chair Gary Gensler said in a lengthy statement:

Gemini co-founder Cameron Winklevoss lauded the decision as a “watershed moment” that reshapes the SEC’s authority over digital assets.

“The sale of XRP on exchanges is not a security. Which means the sales of all cryptos on exchanges are not securities and SEC and Gary Gensler have no jurisdiction over them,” said Winklevoss.

Yet, for the myriad of tokens listed in the Binance and Coinbase lawsuits, their future remains uncertain, especially after the sell-off that most of these altcoins have experienced.

Cryptos Labeled Securities Underperform

Since early June, the 19 cryptocurrencies identified as securities in the SEC’s lawsuits against Binance and Coinbase have experienced notable declines.

For example, BNB, ADA, and MATIC have witnessed a decrease in their market valuations by 28.8%, 29.8%, and 32.2%, respectively. In contrast, Solana’s SOL token has demonstrated resilience, with a minimal 1.0% dip as of this writing.

BNB, ADA, MATIC, and SOL Price Performance. Source: TradingView

Other altcoins, including Cosmos, Internet Computer, Filecoin, and Near Protocol, have undergone even more pronounced corrections. Specifically, ATOM has decreased by 32.4% since June 5, while ICP, FIL, and NEAR have seen declines of 26.3%, 33.7%, and 26.1% respectively.

ATOM, ICP, FIL, and NEAR Price Performance. Source: TradingView

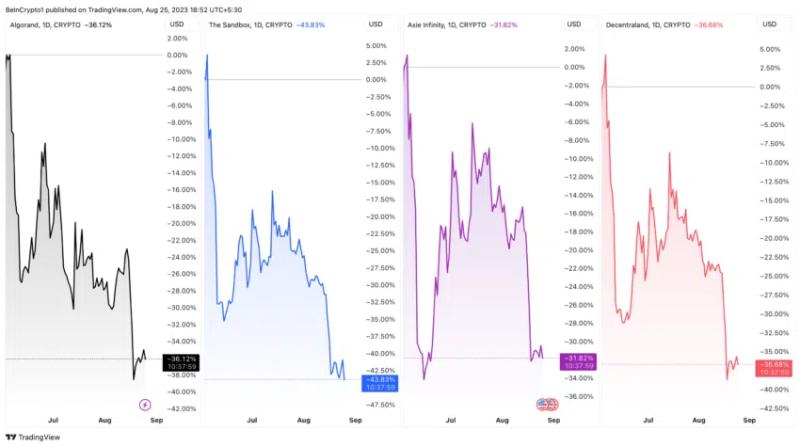

Similarly, the wider crypto market has shown little mercy to Algorand and metaverse tokens like The Sandbox, Axie Infinity, and Decentraland. ALGO has seen a drop of 36.1%, SAND by 43.8%, AXS by 31.8%, and MANA has plummeted by 36.7%.

ALGO, SAND, AXS, and MANA Price Performance. Source: TradingView

Flow, Nexo, Chiliz, and Dash have also faced substantial downturns. In particular, FLOW, CHZ, NEXO, and DASH have declined by 37.5%, 39.8%, 11.8%, and 40.8% respectively.

FLOW, CHZ, NEXO, and DASH Price Performance. Source: TradingView

Finally, COTI and Voyager Token, the last two altcoins identified as securities in the lawsuits, have not been spared either. Their respective native tokens, COTI and VGX, have fallen by 43.9% and 19.6%.

COTI and VGX Price Performance. Source: TradingView

The importance of clear and consistent regulatory frameworks becomes evident as the line blurs between traditional finance and the emerging cryptocurrency market. While some cryptocurrencies have managed to weather the storm, many face uncertain futures.