The federal court’s ruling could be a game-changer for the crypto industry, but the legal saga is far from over.

Ripple Didn’t Violate Securities Laws, Partially

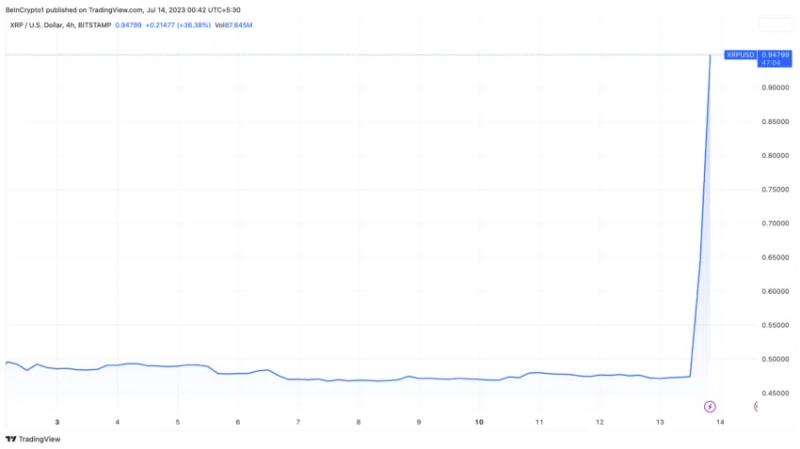

The US District Judge Analisa Torres has ruled that Ripple did not violate federal securities law by selling XRP on crypto exchanges. This decision sent the price of XRP soaring, with the crypto experiencing a 104% surge following the announcement.

However, the ruling was not an unequivocal win for Ripple. Judge Torres also stated that the company contravened the federal securities law when selling XRP directly to sophisticated investors. As a result, Ripple may still face significant legal hurdles ahead.

XRP Price Performance. Source: TradingView

Interestingly, Torres’s decision marked the first time a US judge favored a crypto company by deeming certain XRP sales outside US securities law. The ruling differentiated between Ripple’s “blind bid” sales, in which the company did not know the identity of the buyer, and direct sales to institutional investors.

Torres ruled that the blind bid sales did not breach securities laws, but the direct sales did.

Ripple Lawsuit Is Pivotal for the Global Crypto Market

Despite the mixed ruling, Ripple’s executives, particularly CEO Brad Garlinghouse, celebrated the decision. He viewed it as a step in the right direction for cryptocurrency innovation in the US.

Likewise, Stuart Alderoty, Chief Legal Officer at Ripple, concluded that the judge’s decision affirms that the “SEC does not have unbounded jurisdiction over crypto.”

“A huge win today – as a matter of law – XRP is not a security. Also, a matter of law – sales on exchanges are not securities. Sales by executives are not securities. Other XRP distributions – to developers, charities, and employees – are not securities,” said Alderoty.

Torres left the question of whether Garlinghouse and Larsen are personally culpable for the institutional sale violation to be resolved in a jury trial.

Although this landmark decision in the Ripple lawsuit constitutes a significant step in defining the nebulous relationship between cryptos and securities law, the battle between Ripple and the SEC is far from resolved.