These platforms are sidestepping the necessary protocols and actively misleading potential investors. With high and real stakes, how can one tread safely in the cryptocurrency market?

Hong Kong Warns of Unlicensed Crypto Exchanges

Unscrupulous entities are misleading the public by falsely claiming to have submitted licensing applications to the SFC. Such claims provide a dangerous semblance of legitimacy.

Investors must remember that misrepresentation to induce crypto trading is an offense under section 53ZRG of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO).

Despite transitional arrangements set up under the new regime to allow crypto exchanges to comply with regulatory requirements, some entities have brazenly set up new operations, publicizing their intent to acquire licenses. Yet, some services and products do not align with legal and regulatory requisites.

One major red flag is the launching of new cryptocurrencies for retail clients or services like “deposits,” “savings,” or “earnings” that do not fit within the new regulatory framework. Indeed, such offerings raise questions about these platforms’ intentions and could hamper their potential future licensing.

Established entities of unlicensed VATPs operating in Hong Kong must also ensure they are in compliance. Not having an SFC license and conducting activities could lead to criminal charges.

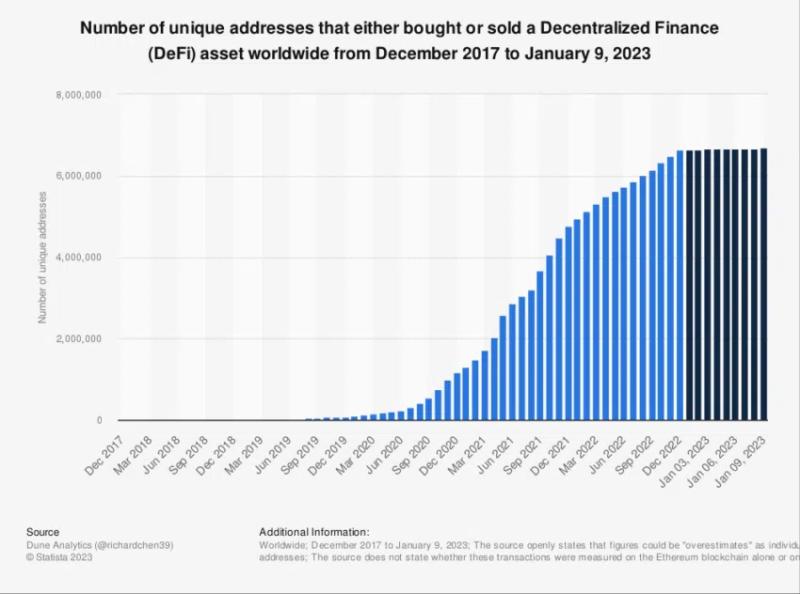

As decentralized trading spreads rapidly through East Asia and the world, it is all the more essential to stick with licensed exchanges and avoid bad actors. Source: Chainalysis

List of Licensed Crypto Exchanges in Hong Kong

For investors, these revelations are unsettling. In its bid to protect and educate, the SFC emphasizes that most crypto exchanges accessible to the public are yet to be regulated. Therefore, trading on unlicensed platforms poses significant risks, from potential collapses and hacking to other forms of asset misappropriation.

To stay safe, investors are advised to check the SFC’s published list of licensed virtual asset trading platforms. This list provides clear insights into the platforms that have received the SFC’s seal of approval.

Currently, only two virtual asset trading platforms have secured the coveted license from the SFC:

- OSL Digital Securities Limited operates the “OSL Exchange,” licensed on December 2020.

- Hash Blockchain Limited operates the “HashKey Exchange,” licensed on November 2022.

It is essential to remember that while the SFC provides these listings, it does not guarantee the performance or creditworthiness of the platforms. Hence, investors should carry out their due diligence.