Recent reports show that US inflation is cooling down and the job market is weakening. In July, the US Consumer Price Index (CPI) increased by 3.2% compared to the previous year, slightly lower than experts’ predictions. Weekly jobless claims were also slightly higher than expected. Despite these reports leaning towards the possibility of the Federal Reserve loosening monetary policies, it hasn’t significantly affected gold due to the strong US Dollar.

China’s central bank might stimulate its economy in the coming weeks. If these efforts don’t yield results within a few months, it could affect other major economies. This could decrease the market for raw materials, putting pressure on the precious metal market.

Despite these challenges, experts remain optimistic because central banks still have a substantial interest in gold. According to the latest international financial statistics released by the International Monetary Fund (IMF), central banks continue to strengthen their gold reserves.

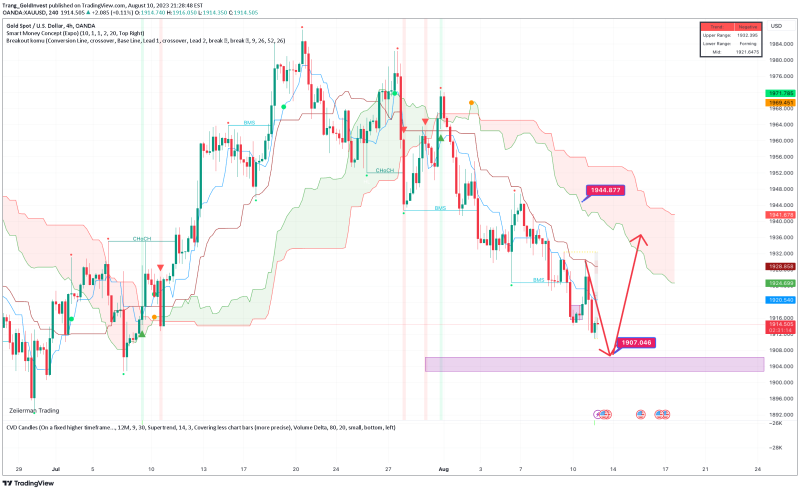

Trading Strategy:

SELL XAUUSD between 1928-1932

Stop Loss: 1937

Take Profit 1: 1925

Take Profit 2: 1920

Take Profit 3: 1915

BUY XAUUSD between 1903-1907

Stop Loss: 1900

Take Profit 1: 1915

Take Profit 2: 1920

Take Profit 3: 1925

Note: Allocate 1% of your account for capital management. Avoid exceeding 5% of your capital within the nearest 10 price increments. Always maintain Stop Loss in all circumstances, considering your current financial resources when entering trading positions. Comment: The market can still go down to the 1905 resistance, everyone. Comment: Everyone please remember to subscribe to my channel so I can have more good analysis. Without being too fussy