Markus Thielen from 10X Research predicts that Bitcoin price could reclaim the $70,000 mark soon and hit a new ATH crossing the $73K level in October. By Boluwatife Adeyemi 1 day ago Updated 20 hours ago

Highlights

- 10x Research analyst Markus Thielen predicts that Bitcoin will witness a swift move to $70,000.

- He also predicted that BTC could rise to a new all-time high by late October.

- Thielen believes that the rise in Stablecoin liquidity and China’s stimulus policy can fuel this Bitcoin rally.

Markus Thielen, the renowned founder of the leading analytics firm 10X Research, predicts Bitcoin price to hit $70,000 in the coming weeks. In addition, he also said that BTC could soar past its previous ATH of $73,000 in October, sparking market optimism.

Meanwhile, Thielen has cited reasons like stablecoin liquidity, and China’s softening stance with their monetary policy, among others, as the primary reasons behind his prediction.

Bitcoin Price To Reach $70,000 And Then New ATH

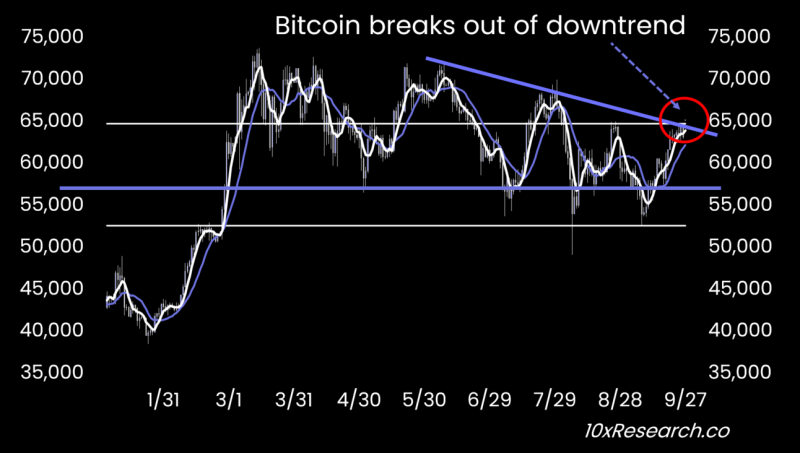

In the latest 10x market update, Thielen predicted that the BTC price would move toward $70,000 in the next two weeks and then reach a new ATH by late October. He highlighted how Bitcoin’s recent break above $65,000 has confirmed the breakout from the downtrend and paved the way for this rally to the upside.

Thielen’s accompanying chart showed that the Bitcoin price could rise to $75,000 when this projected price rally occurs. The analyst also mentioned the surge in the stablecoin liquidity and China’s recent quantitative easing (QE) measures as what could spark this next crypto wave. This aligns with the CoinGape report on how BTC could reach $80,000 in October.

Stablecoin minting has increased sharply since July, as issuers like Tether and Circle issued almost $10 billion in the weeks following the July 31 FOMC meeting. Thielen noted that Circle, which typically offers its services to regulated institutions, accounts for 40% of the recent stablecoin inflows, indicating an influx of large market players into the crypto space.

How China Will Contribute To The BTC Rally

Meanwhile, Thielen highlighted how China’s history with Bitcoin and the country’s recent stimulus measures could contribute to the Bitcoin price rally. 55% of currently mined Bitcoin is said to come from Chinese mining pools, while the country dominated 90% of global BTC trading back in 2014. He also claimed Chinese exporters used over-invoicing to funnel billions into BTC in 2013, which triggered a massive rally.

In line with this, the analyst predicts that the stimulus measures could trigger significant capital outflows from China into the crypto market. Furthermore, Thielen asserted that the $278 billion Chinese stimulus plan could ignite a parabolic rally for BTC and other cryptocurrencies, especially with global liquidity rising.

Interestingly, the 10x Research founder also hinted that Donald Trump could play a major role in the BTC rally extending till next year. He claimed that Trump, if re-elected, may seek to overstimulate the US economy, potentially pressuring the Federal Reserve to cut interest rates by the first half of 2025 totally.

Arthur Hayes predicted that Bitcoin would benefit from the ‘volatility supercycle,’ an allusion to the monetary easing policies of world governments, including the US. He expects that fiat printed by these governments will flow into BTC and the broader crypto market.

Bitcoin’s Dominance Is At Risk

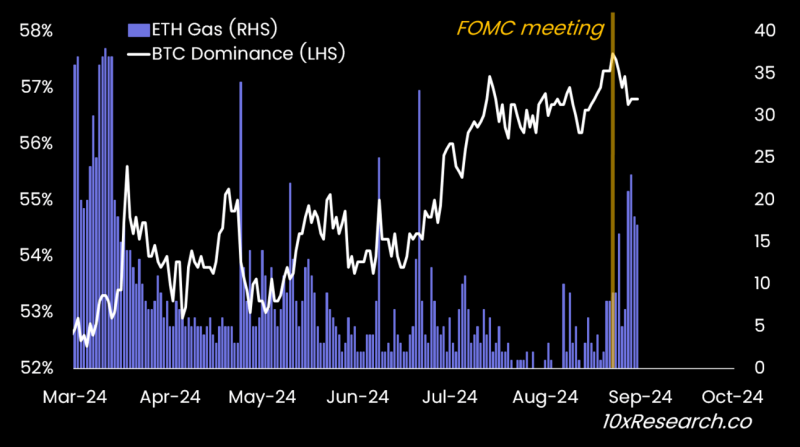

Although the Bitcoin price is set to continue rallying, Markus Thielen suggested that BTC’s dominance is at risk. He noted that the dominance has waned since last week’s FOMC meeting when the Fed cut interest rates by 50 basis points (bps). Since then, Ethereum gas fees have spiked thanks to the surge in altcoin activity across the crypto market.

The analyst predicts that this trend will likely continue if the Federal Reserve remains open to cutting rates. The Fed already suggested that there could be two 25 bps rate cuts before this year ends.

At the time of writing, the Bitcoin price is at around $65,500, down in the last 24 hours. Trading volume is also down by over 33%, with $26.3 billion traded during this period.

However, it’s worth noting that the upcoming US Job data will also play a crucial role in deciding the crypto’s future in October. Given the crypto’s historical positive performance in the month, many are anticipating the crypto to showcase a similar momentum this year.