Bybit’s new product enables traders to profit quickly from large price swings, provided the current price differs from a settlement. KuCoin customers can lock in buying and selling prices for over-the-counter (OTC) trading, which can be settled without platform intervention.

Bybit and KuCoin New Products Need Due Diligence

To use KuCoin’s Pre-Market product, customers must pay a security deposit to place or fulfill orders as buyers or sellers. A failure to fulfill either side’s obligations will result in a forfeiture of the security deposit.

Customers can also create sell orders that can be fulfilled when the token goes live on KuCoin. The move could appeal to more advanced traders familiar with the process of matching trades.

The product can pose a risk to investors since it allows trading of tokens that have not yet been listed. While KuCoin made know your customer (KYC) checks mandatory in June, investors could still face other risks from rug pulls and poor tokenomics.

A subsidiary of MEK Global Limited, KuCoin is registered as a digital asset exchange with the Financial Services Authority of the Seychelles. It was recently placed on the UK Financial Conduct Authority’s warning list for non-compliance with new financial promotion rules.

Bybit’s product, on the other hand, maximizes profits from sharp price movements as long as an asset’s price is outside a settlement range. The move, while attractive, could make short-term traders view crypto as a means to reap large profits.

Bybit hopes to secure a full market license from Dubai’s Virtual Assets Regulatory Authority to expand its customer base beyond accredited investors. If this happens, retail traders could suffer a disadvantage due to their lack of experience in a high-speed industry traditionally dominated by hedge funds and trading firms.

Exchanges Face Tough Road Ahead

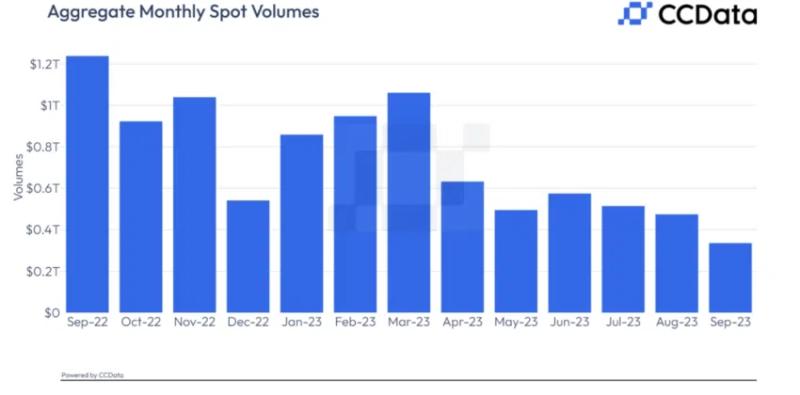

The new promotions come as retail traders face a volatile market until institutions can find a regulated vehicle to inject much-needed liquidity. It takes smaller transactions to move an asset’s price in a thinly traded market than in a deeply liquid market.

Spot Volumes Decline | Source: CCData

Rising interest rates can also have a bearing on crypto trading if customers borrow money to fund trades. As a result, despite the attractive propositions to improve profits, customers may choose instead to invest in low-risk bonds while they wait out the US Federal Reserve’s tightening cycle.

The industry also faces scrutiny after Hamas, a militant group occupying the Gaza Strip, allegedly funded its offensive against Israel using cryptocurrency. Israeli police have seized the funds with the assistance of Binance last week.

The news caused US Senators Elizabeth Warren and Sherrod Brown and other anti-crypto US lawmakers to call for a quick government response. Brown has pledged to use the resources of the Senate Banking, Housing, and Urban Affairs Committee to find out exactly what role crypto played in the recent attacks.