Although the reason for the widespread withdrawals was largely unknown, actions like this point to a possible conviction that the token was worth keeping for the long term.

- Millions of WLD tokens have been sent out of exchanges in recent times.

- The short-term sentiment around the project remains optimistic.

According to smart money tracking account Lookonchain, Worldcoin [WLD] may have regained the attention of large investors. This includes individual whales and institutions in the market. This assertion was because a fresh wallet withdrew $6 million worth of WLD from the OKX and Binance exchanges.

Around the same period, Amber Group, which is a liquidity provision, asset management, and trading platform, also sent out 500,000 WLD from OKX. After withdrawing, Amber sent the tokens into a non-exchange wallet. Leading trading firm GSR was also not left out of the picture as it has been accumulating WLD since 29 August.

The conviction is unwavering

Although the reason for the widespread withdrawals was largely unknown, actions like this point to a possible conviction that the token was worth keeping for the long term. The perception that Worldcoin could also be backed up by price action in recent times.

Unlike most altcoins, WLD’s 30-day performance was a 9.49% increase. Furthermore, the weighted sentiment, according to on-chain data was 0.224. Weighted sentiment combines positive and negative commentary about a project by examining the unique social volume to arrive at a score.

This metric spike when the vast majority of messages are positive, and falls when a chunk of the messages is negative. For WLD, the sentiment score has flatlined since 13 October, meaning market players are currently neutral on the token’s performance.

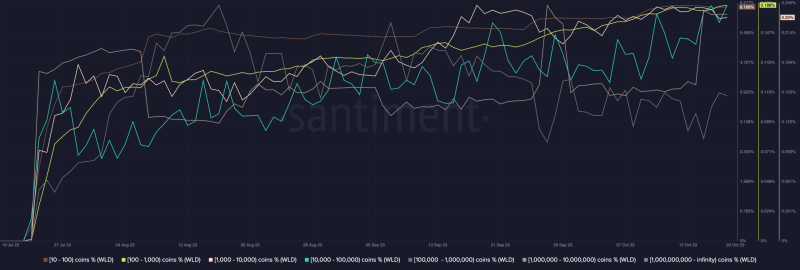

Besides the short-term sentiment and whale exchange withdrawals, it seemed that the retail cohort was also bullish on Worldcoin in the long term. This was because of the state of the balance of addresses.

According to Santiment, the 1-10 million cohort had the highest holding of WLD. This cohort has also increased their balance over the last 30 days. Also, the retail segment with 10-100 tokens was not left out, increasing their share to 6.17%.

Silence in Altman’s land

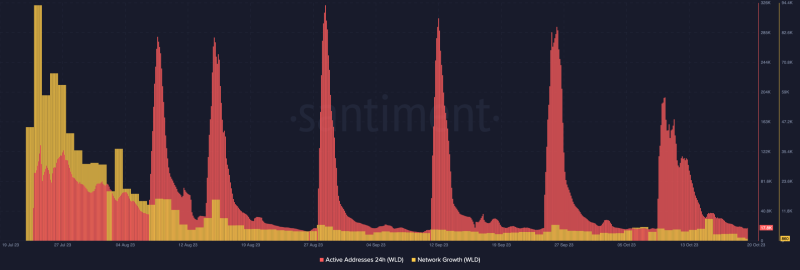

However, the activity on the Worldcoin network has been somewhat quiet. At the time of writing, active addresses were down to 17,800. This metric measures the number of distinct addresses involved in transactions on the blockchain.

Therefore, the decrease implies that interaction with WLD has been much less than it was some weeks back. Meanwhile, the network growth also decreased. Network growth shows the number of new addresses interacting with a network and can serve as an indicator of adoption.

So, the decrease means that new addresses joining the Worldcoin network are refraining from improving the project’s traction.