While Bitcoin’s funding rate has returned to normal levels amid a price drop, the overall market sentiment is still bullish. PromotedAd $PIKA – Fastest-growing GameFi token. Join the Presale Now! Pikamoon ($PIKA) – Join the Presale Now! By Coingape Staff 53 mins ago Updated 10 mins ago

The funding rate for Bitcoin, the leading cryptocurrency by market capitalization, has started to revert to normal levels following the recent rally that pushed many traders to pay higher-than-usual fees to remain in their long positions.

Will BTC Rally Continue After Funding Rates Normalize?

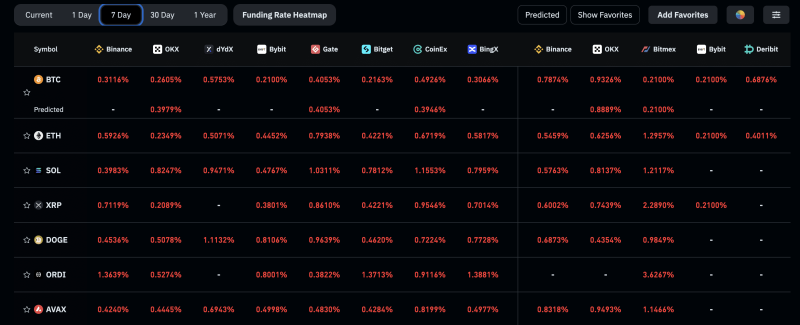

According to data from Coinglass, traders paid anywhere from 0.19% to 0.93% in fees for Bitcoin on their borrowed funds to remain in their long positions in the last seven days. The fees went as high as 4.6% for Bitcoin-based ORDI tokens.

Funding rates for other major tokens — including Ethereum, Solana, and XRP — have also normalized, suggesting that many market buyers are bearish. As the crypto futures funding rates reset, the crypto market saw nearly 138 million in cumulative liquidations in the past 24 hours, data shows.

By definition, funding rates are periodic payments between short and long traders, aimed at keeping the price of an asset’s perpetual future contract close to its spot price. A perpetual futures contract is an agreement to purchase or sell an asset at a pre-agreed price, with the contract lacking an expiration date.

In essence, funding rates reflect the overall sentiment of traders and their projections for future market trends. A negative funding rate signals that traders are short, meaning they expect the market to go down. Similarly, a positive funding rate indicates that traders are long, and anticipate an upward trajectory in the market over time.

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

Traders Anticipate BTC Rally To Continue

The screenshot below shows how funding rates under zero indicate that most traders expect lower Bitcoin levels to come. However, analysts expect Bitcoin to continue its uptrend despite the recent pullback.

Image credits: Coinglass

“Bids filled, all metrics look fantastic still, send it,” an X post by prominent trader and analyst Credible Crypto reads. Fellow trader Crypto Ed, creator of the trading team CryptoTA, has echoed similar sentiments.

At the time of writing, Bitcoin price was trading at $43,214, down 1.41% from the previous close. Meanwhile, the open interest in the futures market stood at around $43 billion, with Bitcoin’s open interest falling to $19 billion.