- Idiosyncratic factors keep BTC under pressure as gold rallies to record high.

- Gold’s surge hints at a favorable macroeconomic conditions for bitcoin ahead.

- Some analysts caution against reading too much into the gold rally.

Gold rose to a new record high reaching $2,564 per ounce on Friday, taking its quarter-to-date gain to 10%. Bitcoin (BTC), often touted as digital gold, remained under pressure at nearly $58,000, representing a 7% quarterly loss, according to CoinDesk data.

The yellow metal’s performance looks even more impressive, if you consider that Wall Street’s benchmark index (S&P 500) has only eked out a meager 2% rise this quarter. Bitcoin has recently moved in tandem with technology stocks amid fears of a U.S. economic recession and the threat of mass unwinding of the “risk-on yen carry trades.”

Most observers are of the opinion that idiosyncratic factors are responsible for the ongoing BTC-gold divergence, and the rally in the yellow metal suggests favorable macroeconomic conditions for the cryptocurrency ahead.

Per Charlie Morris, chief investment officer and founder of ByteTree, gold’s surge is linked to increased accumulation by central banks, a privilege bitcoin still lacks, which also suggests monetary policy easing eahead.

“The appeal of government bond in reserves is lesser and gold has stepped up. Many central banks are accumulating gold, which used to be priced off U.S. Treasury inflation-protected securities but is now being influenced by global factors like structural government deficits,” Morris told CoinDesk.

“The strength in gold reflects increasing current and future [fiat] money supply, among other things, and bitcoin will rally when the economy picks up or when the sound of stimulus is heard,” Morris added.

The year-on-year change in the combined fiat money supply growth of U.S., Eurozone, U.K. and Japan flipped positive in August and could continue to grow as central banks embark on renewed liquidity easing. The European Central Bank cut interest rates on Thursday, and the Fed is likely to do the same next week, kicking off the so-called easing cycle, meaning stateside investors could soon hear the sound of stimulus.

André Dragosch, head of research Europe at Bitwise, opined that gold’s rally likely indicates a sharp slide in inflation-adjusted U.S. government bond yields ahead. The decline in the so-called real yields typically has investors rotating money into riskier investments like bitcoin and technology stocks, as observed in 2020.

“Gold prices have completely decoupled from U.S. real yields. This implies two things: Either gold is overpriced, or gold is already anticipating a massive decline in U.S. real yields,” Dragosch told CoinDesk. “A massive decline in U.S. real yields is equivalent to a sharp easing in monetary policy, which is not yet priced more broadly into financial markets except in gold, which is why bitcoin and other assets might follow gold higher.”

The U.S. 10-year real has already pulled back to 1.61%, the lowest in over a year, from the peak of 2.52% in October, according to data source TradingView.

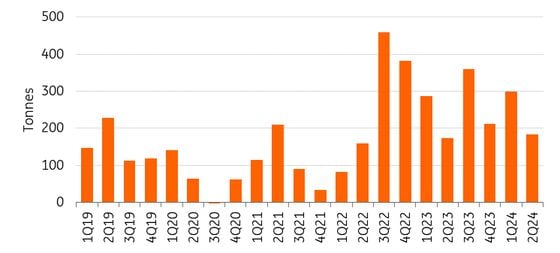

Gold-bitcoin demand divergence

Central banks snapped up 37 tonnes of Gold in July, doubling net purchases from the preceding month, according to the World Gold Council. That’s the highest monthly since January, when net purchases were 45 tonnes.

In 2022, central banks purchased a 1,037 tonnes of gold, the second-highest annual purchase in history, following a record 1,082 tonnes in 2022.

In contrast, the bitcoin market has been hit with supply worth billions of dollars since June, thanks to liquidations by Germany’s Saxony state, Mt. Gox creditor reimbursements and the U.S. government.

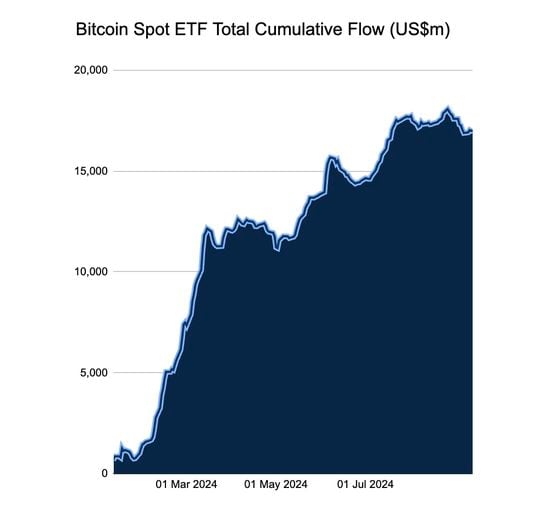

Meanwhile, the uptake for the 11 U.S.-listed spot exchange-traded funds has weakened in recent months and the funds have witnessed a net outflow of around $1 billion since late August, according to data source Farside Investors.

The outflows and supply increase explains BTC’s dour performance, according to the LondonCryptoClub newsletter service.

“Gold is anticipating lower real rates, rising liquidity and a softer dollar, much like bitcoin. Overlaying that, however, is the supply/demand dynamic. Gold has seen huge demand from central banks, but little negative supply, whereas bitcoin has had to digest a lot of supply in recent months from the German and U.S. government and the Mt Gox distribution,” founders of the LondonCryptoClub told CoinDesk

“Short-term, gold outperformance can be seen as a lead on where BTC should be headed,” founders added.

That said, not everyone in the crypto market is psyched by the gold rally.

Alex Kruger, a partner at the digital assets and macro advisory firm Asgard Markets, cautioned investors from reading too much into the gold rally as far as bitcoin is concerned.

“Its irrelevant. Bitcoin never trades with gold. When you look too intently into something, you end up seeing what you want to,” Kruger said in a Telegram chat, as some market participants drew parallels with 2020 when gold rose to record highs before BTC.

Besides, traders should be watchful of a renewed August-like growth scare in risk assets, which saw BTC nosedive to $50,000. A potential 50 basis point rate cut by the Fed next week might just do that.

“Bitcoin is a risk-on asset, gold risk-off. Gold likes the system to be cold and falling rates. In contrast, bitcoin likes the system to be overheating,” Morris noted.

9:50 UTC: Correction: Andre Dragosch is a head of research Europe at Bitwise, which recently took over the ETC Group.

Edited by Parikshit Mishra.