Pepe’s whales ride the profit wave amidst price fluctuations. Notable withdrawals and mysterious volume spikes hint at heightened activity in the token’s dynamic ecosystem.

- A Pepe whale withdrew $3 million worth of tokens from exchanges.

- Previous withdrawals resulted in a profit of around $600,000.

Although PEPE appears to have lost momentum in both price and hype, its whales were still actively profiting. Recent data revealed a notable whale transfer of PEPE tokens, which coincided with a positive price trend.

– Is your portfolio green? Check out the Pepe Profit Calculator

Pepe whale makes the money move

As per a post from Lookonchain, a Pepe whale recently made a substantial withdrawal from Binance. According to the data from the tracking site, the whale withdrew 2 trillion PEPE tokens, valued at approximately $3 million.

Additionally, the post mentioned that this same whale had previously withdrawn 3.94 trillion PEPE tokens, worth $6.46 million at that specific time, on two occasions – once on 27 June and then again on 5 July. Moreover, the whale deposited 3.94 trillion PEPE tokens, valued at $7.06 million at that time, on 14 July, resulting in a profit of around $600,000.

PEPE profit-taking trend

On 23 July, the recent whale move proved profitable, as evident from the daily timeframe chart of the PEPE token. The chart displayed a price surge that day, with the token closing trading with a gain of over 1%.

Similarly, on 27 June, the asset had a noteworthy increase in value, closing the trading session with a significant 6.6% rise. However, the only exception to the overall profit-taking trend was observed on 5 July, when the price experienced a decrease of over 2.9%.

However, as of this writing, the token faced a downtrend, with a considerable loss of over 9% already recorded. This persistent decline in price further pushed PEPE into a bear trend, as indicated by its Relative Strength Index (RSI).

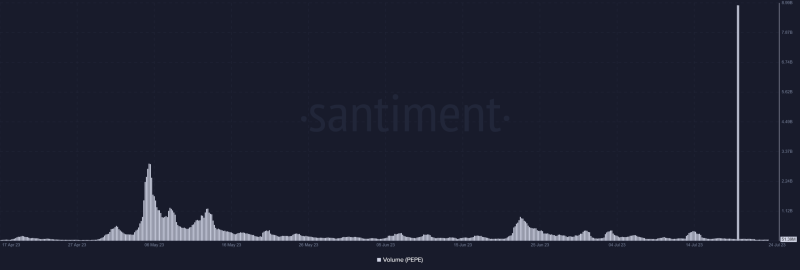

Volume trend spikes and falls

During the period when these whale transactions were taking place, the overall volume of PEPE tokens remained relatively low, as indicated by the Santiment chart. However, there was one significant spike in volume observed on 20 July.

On this particular day, the volume surged well beyond the usual range of 70 to 100 million and reached over 8 billion. This marked the highest volume the token had seen since its launch.

The exact cause of this sudden spike in volume remains unknown, and it did not immediately impact the price trend. Nevertheless, this unusual surge suggested a heightened level of whale activity during that period.

– Read Pepe’s [PEPE] Price Prediction 2023-24

Additionally, based on the reported whale moves, it appears that the whales were primarily using the token for profit-taking purposes, as there were no other apparent utility or use cases for the token then.