Bitcoin starts the week with a trip to $26,000 — can BTC price strength overcome sellers and a weekly “death cross?”

Bitcoin (BTC) starts the last week of September with a retest of $26,000 as a stubborn range persists.

An unimpressive weekly close sets the tone for the culmination of a traditionally lackluster month for BTC price action.

Having shaken off a hectic week of macroeconomic events, Bitcoin has plenty more to weather before September is over. United States gross domestic product figures for Q2 will come on Sept. 28, with Personal Consumption Expenditures (PCE) data following the day after.

The highlight, however, will likely come in the form of a speech from Jerome Powell, chair of the Federal Reserve, a week after it opted to hold U.S. interest rates at current elevated levels.

Inflation remains a major talking point into Q4, and Bitcoin still lacks direction as week after week goes by without a clear upward or downward trend emerging.

Will this week be different? The countdown to the monthly close is on.

BTC price weekly chart prints “death cross”

BTC price performance, while steady over the weekend, deteriorated after the Sep. 24 weekly close.

BTC/USD took a trip to $26,000, data from Cointelegraph Markets Pro and TradingView shows, with this level still managing to hold as support at the time of writing prior to the week’s first Wall Street open.

Eyeing the state of play on exchanges, commentators noted liquidations occurring for long and short BTC positions.

Bitcoin is still near two-week lows, bolstering arguments from already cautious analysts over what might come next.

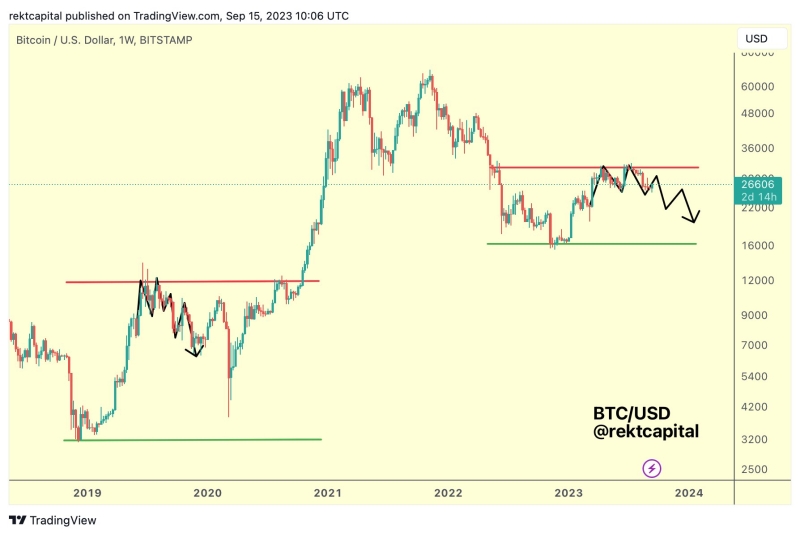

Popular trader and analyst Rekt Capital continued to track what he suggested could be a repeat of previous BTC price behavior. 2023, he argued at the weekend, might end up looking just like 2019 — its counterpart from the last cycle.

“Bitcoin could follow the same bearish fractal from 2019 to drop lower in this Macro Range,” he suggested alongside a comparative chart.

In a subsequent debate on X, Rekt Capital put the potential fractal downside target at near $20,000.

Keith Alan, co-founder of monitoring resource Material Indicators, meanwhile spied a so-called “death cross” on weekly timeframes.

Here, the falling 21-week simple moving average (SMA) has crossed under its rising 200-week counterpart — a phenomenon that highlights the comparative weakness of recent price action.

Uploading a chart showing a downside warning from Material Indicators’ proprietary price tools, Alan added that this would be invalidated should BTC/USD reclaim $26,500.

A #DeathCross + a new Trend Precognition ⬇️ Signal on the #btc Weekly Chart (Pump > $26.5 to invalidate).

Any questions? pic.twitter.com/aBa64Be56D

— Keith Alan (@KAProductions) September 25, 2023

A more optimistic take came from trader and analyst Credible Crypto, who believed a rebalancing of market composition would result in a return to $27,000.

“We had clear, visible and confirmed accumulation occurring in the green square,” he commented on a chart, building on analysis from the weekend.

The return of volatility is fantastic news for traders.

More Fed uncertainty is back and we are ready for it.

We're publishing our trades for the week shortly.

In 2022, our calls made 86%.

Subscribe to access our analysis and see what we're trading:https://t.co/SJRZ4FrNBc

— The Kobeissi Letter (@KobeissiLetter) September 24, 2023

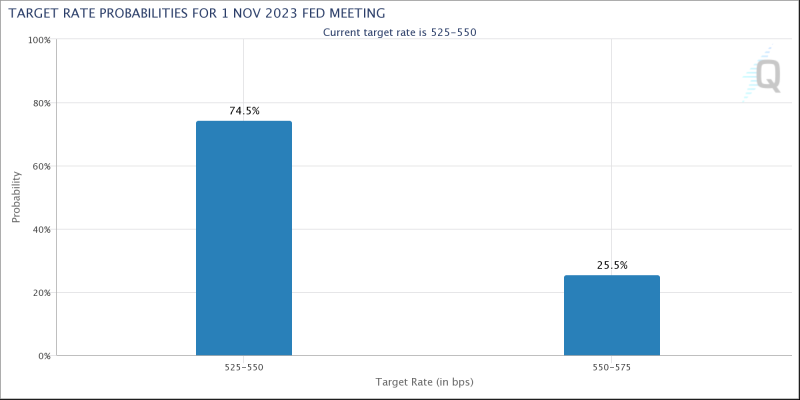

Prior to the data and Fed speakers, markets are pricing in a 75% chance that interest rates stay anchored at present levels at the next decision meeting in November, per data from CME Group’s FedWatch Tool.

Waiting in the wings before that, meanwhile, is the threat of a fresh U.S. government shutdown over budget wrangling. Politicians have until Oct. 2 to avert one, notes pro-Bitcoin commercial litigator Joe Carlasare.

Major October Catalysts (Part 2)

Predictive markets now anticipate a 70% of a Government Shutdown on October 2.

Millions of federal workers face delayed paychecks when the government shuts down, including many of the roughly 2 million military personnel and more than 2 million… pic.twitter.com/XTrt0g06t2

— Joe Carlasare (@JoeCarlasare) September 24, 2023

Analysis dismisses BTC exchange balance drop

Bitcoin available to buy on exchanges may be near its lowest levels since 2018, but this is no cause for celebration or even bullishness, one longtime analyst argues.

For Willy Woo, creator of the statistics platform Woobull, the “synthetic” nature of exchanges’ BTC balances means that their multi-year decline does not represent the BTC supply becoming more illiquid or scarce.

“Will buying up the inventory of BTC on exchanges moon the price? NO! This is a fallacy,” he told X subscribers in a thread at the weekend.

He subsequently gave significance on the 200-week EMA holding as support.

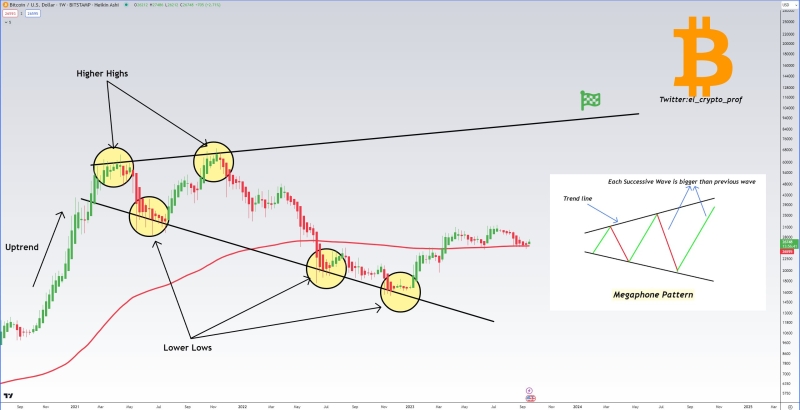

“95% wait for lower prices that won’t happen.,” he wrote in part of the accompanying commentary, with another chart placing BTC/USD in an expanding “megaphone” structure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.