Bitcoin mining faces profitability concerns as hash price nears record low, despite a surge in network hash rate. By Sunil Sharma 1 hour ago Updated 1 hour ago

In the constantly evolving landscape of Bitcoin mining, there’s a pressing challenge emerging for miners worldwide. According to Bloomberg, a critical metric, the hash price, is nearing a record low, spelling potential financial troubles for mining operations. The stagnating Bitcoin price, coupled with heightened competition, has put this cornerstone of the cryptocurrency world under the microscope.

Surging Hash Rate vs. Slumping Revenue

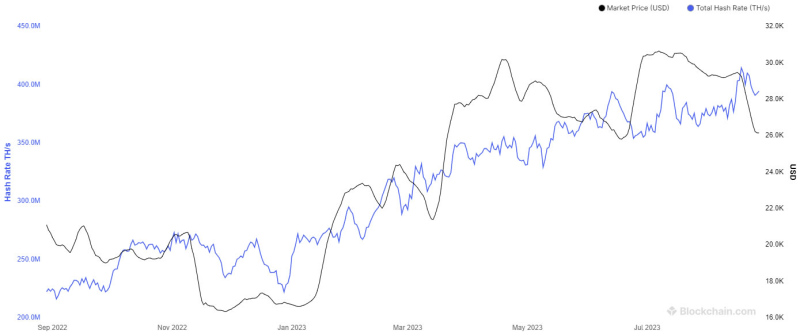

Interestingly, while the hash price is plummeting, the Bitcoin network’s hash rate is experiencing an opposite trajectory. Over the past year, the hash rate has surged by an impressive 80%, reaching a peak of 414 exahashes per second (EH/s) on August 18. This signifies more computational power and resources being poured into the network. Yet, the diminishing returns in terms of revenue are a concerning juxtaposition.

BTC/USD hash rate vs. price, Source: Blockchain.com

A renowned market analyst, Dylan LeClair, shed light on the situation, highlighting that newer, more efficient mining rigs are constantly being developed. However, he also emphasized the importance of the Bitcoin price catching up. According to LeClair, for mining to remain lucrative at such elevated hash rates, Bitcoin prices need to adjust upward.

Top Crypto Marketing Firms / Agencies 2023; Here’s Best Picks [Updated] Must Read Crypto Telegram Channels List 2023 [Updated] Must Read Top 10 Web3 Games To Explore In 2023; Here List Must Read

Remember the $BTC miner revenue spike this spring?

Well that was fun…

Miner revenue per terahash nearing fresh all time lows, as is tradition. pic.twitter.com/lgugTpHd7n

— Dylan LeClair 🟠 (@DylanLeClair_) August 27, 2023

Struggle to Maintain Profitability

The Bitcoin mining industry has been facing increasing strain as the hash price, a measure of the revenue earned per terahash per second (TH/s) daily, slumped to $0.060. This downturn in mining revenue is reminiscent of the period following the FTX collapse in late 2022.

With the Bitcoin price stagnating at $26,118.15, the revenue for miners isn’t promising, especially compared to earlier this year. During the Bitcoin Ordinals inscription frenzy in May, the demand for block space surged, driving the hash price to nearly double its current rate.

While Bitcoin remains a dominant force in the cryptocurrency market, with a market cap of over $508 billion, the internal dynamics of its mining operations present a puzzle. The interplay between hash rates and hash prices will likely define the future profitability and sustainability of Bitcoin mining. As the industry awaits a potential price adjustment, miners worldwide grapple with the ever-changing challenges of cryptocurrency.